At Zimmer Insurance, we understand that our customers might get confused by insurance lingo. There is certainly a lot to keep up with, so we want clients and prospects to always feel free to ask questions!

One of the many reasons to support small, local insurance agencies (with big-company connections) is the fact we at Zimmer are directly available to clients and prospects to ‘translate’ this lingo.

A common misunderstanding when it comes to industry terminology is between “Replacement Cost” and “Market Value” on a homeowner’s policy. In the insurance industry, the insurer’s duty is to provide financial protection to its clients in the event of loss, in exchange for customer’s payment of the insurance company’s premium. That is the contract between company and insured.

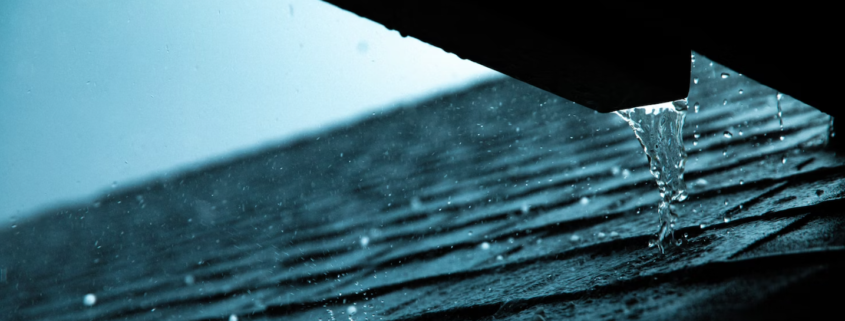

In the case of a homeowner’s policy, losses from things like a windstorm or fire are something the insurance company will pay to fix (up to the limit specified in your policy) during the policy term. Sometimes, however, all the values and numbers can be confusing and seem way too high in some customer’s minds.

Let’s examine the following hypothetical scenario: out of curiosity, you look at your policy and see your Coverage A (dwelling itself that you live in) insurance limit is $400,000, but you maybe only paid $325,000 when you bought the house the previous year.

Some clients will mistakenly believe their Coverage A amount to be an error, or worse, a scam. It is not. This “discrepancy” is a measure to protect insureds, not to scam them.

A quality homeowner’s insurance policy will provide replacement cost, not a depreciated or ‘actual cash’ value for a home and its contents. This replacement cost (i.e., the maximum amount the insurance company will pay to restore the house) amount is not going to be the same as what you paid – often, it’s appreciably more. This may seem strange, but allow us to explain: when you bought your home, you bought it as-is. You did not have to rebuild any of it, it was not on fire or did not have one half of it smashed by a felled tree. There was no damage of that sort that your insurance company must fix. You bought a whole, standing house that wasn’t in a condition of loss. A house in disrepair is another thing, and presumably the price would be contingent upon that.

The insurance company’s job is not to look at what you paid for the house, its job is to look at what it would cost to bring it back to same or better condition, following a claim in which a substantial loss like fire or a tornado occurred, while you own it.

If you buy a house for $325,000 and then it burns to the ground, it is going to cost substantially more than the market value you paid in order to rebuild it. Factors to influence this include (but are not limited to: age of home, size of home, quality/origin of materials used in home like flooring and paint, fluctuation in labor costs, etc.) General inflation will often be accounted for by a 3-5% increase year over year, so if a policy premium goes up slightly even if a loss doesn’t occur do not be alarmed. It is your policy adapting with the conditions of the time in order to keep you financially safe.

Remember that after a loss, the insurance company must pay for debris removal, re-design of the home, materials for construction, and a labor force to put it all together. Flooring, walls, wiring, plumbing, windows, roofing, etc. It is a huge expense, one that is not needed when first buying the home. If your home is especially old, you also must consider that modern codes have to be adhered to. A house built in 1900 is not going to be up to 2022 building codes, so more expenses can be incurred in becoming compliant with government ordinances.

With a quality insurance policy, the difference will protect you in the event of a loss and you can rest easier knowing the variables have been accounted for. As with anything, insurance lives by the mantra “it is better to have it and not need it than to need it and not have it”.

We hope this snippet was of use when considering quotes and policies you get not just from us, but from any insurer. If you have any questions, do not hesitate to reach out to our team of helpful agents and customer service representatives. At Zimmer Insurance, we are always here for you.